Tokenizing TradFi: How Real-World Assets and Smart Bonds Are Revolutionizing Global Finance

You can imagine purchasing a real estate, government bond, or even a share in a private equity fund without the need to transfer a digital token. It is no longer science fiction. Within the framework of decentralized finance (DeFi), tokenized real-world assets (RWAs) and smart bonds are reorganizing the global financial system by bridging traditional finance (TradFi) to a more light-speed and transparent, and accessible financial system.

The emergence of tokenization is not merely a trend; it is also a paradigm shift in the way investors, institutions, and even retail participants respond to assets. Tokenization is transforming liquidity, trust, and accessibility in markets worldwide, through fractional ownership to programmable smart contracts.

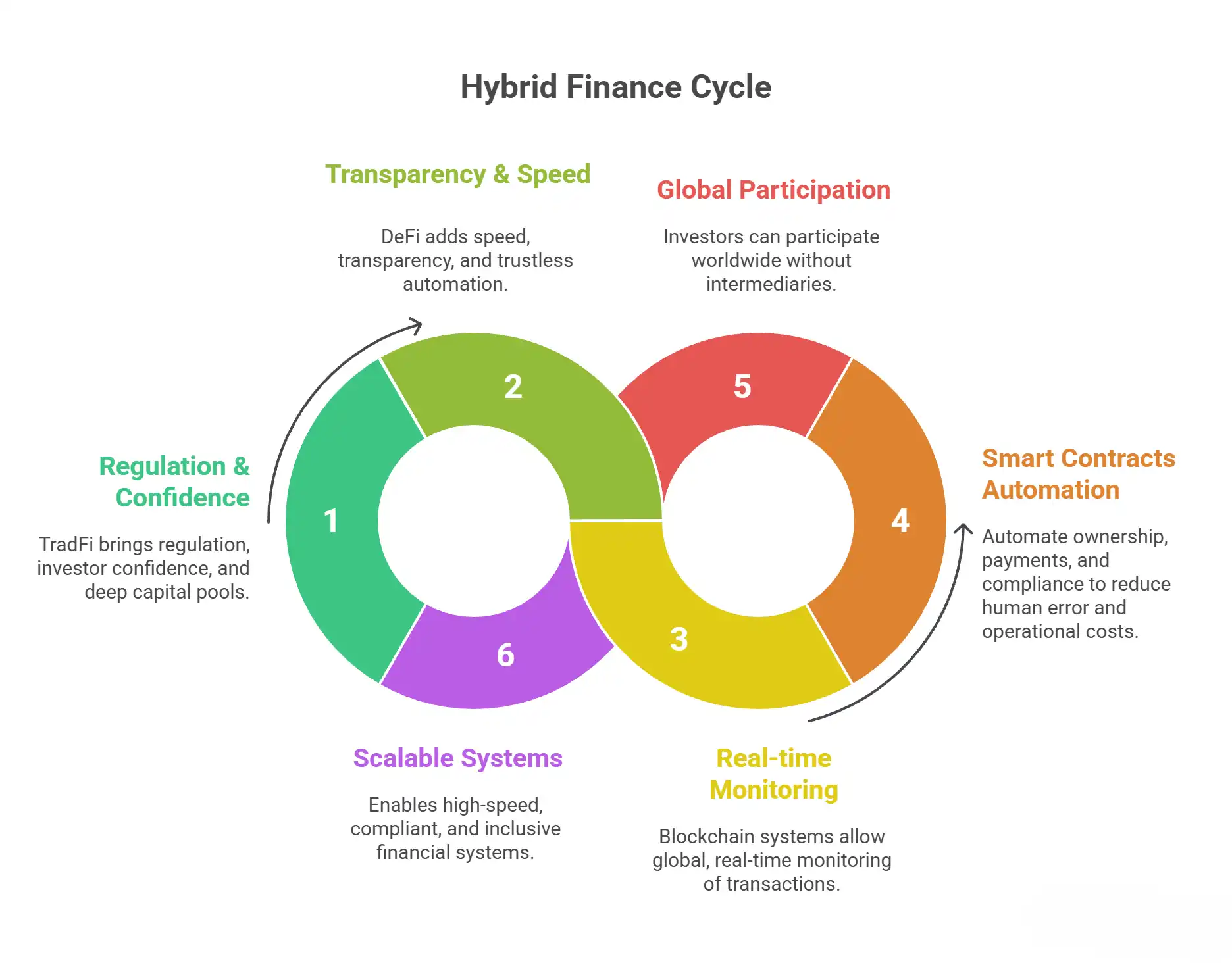

How DeFi and TradFi Complement Each Other to Build Smarter Financial Systems

Each of DeFi and TradFi contributes differently to the current finance. DeFi uses blockchain technology and smart contracts to remove the middlemen. It is 24/7 and provides trustless and transparent systems in which a transaction can be audited and accessed by any part of the globe. This allows users to monitor all financial transactions in real time, making financial transactions less opaque.

TradFi offers regulation, investor confidence, and deep pools of capital. KYC (Know Your Customer) and AML (Anti-Money laundering) are the procedures that help banks and other financial institutions to maintain trust. These regulatory provisions can help curb fraud against users, stabilize the market, and ensure adherence to regulation in the jurisdiction.

Combining them leads to hybrid finance, which is safer, quicker, and more inclusive. Instead of seeing DeFi as an alternative to TradFi, the innovation is in their fusion: to enable scalable, compliant, high-speed financial infrastructure by automating blockchains and regulating them.

The Rise of Hybrid Finance and Tokenized Real-World Assets (RWAs)

Hybrid finance can be defined as the point of intersection between blockchain innovation and conventional financial services. The idea is straightforward: to combine the speed, programmability, and transparency of DeFi with the consistency and reliability of TradFi. Tokenized RWAs are front and center in this change, as physical assets such as bonds, equity, real estate, and other alternative investments become digital tokens, which can be purchased, sold, and managed programmatically.

How Tokenized Assets Bridge TradFi and DeFi

Shared ownership through tokenized RWAs, automated KYC, and smart contracts with smart contract enforcement of real-time asset management are all possible. This implies that investors are able to own a minor part of a property, bond, or fund, without intermediaries, and have transparent, real-time updates about what they own.

Improved efficiency, global access, and short settlement cycles are some of the reasons why banks, real estate developers, and even private equity firms are already considering tokenized RWAs.

Practical Examples

- Bonds – Banks issue programmable tokenized bonds, where interest payments are made automatically through smart contracts, allowing the investor to receive payouts through smart contracts.

- Private Equity – Companies are automating capital tables, rewarding dividends, and enhancing liquidity in historically liquid asset markets using blockchain.

- Real Estate – Developers offer fractional ownership of property to investors worldwide, allowing less capital contribution and opening up liquidity to sellers, for example, E-estates.

- Stablecoins – Digital stablecoins enable near-instant settlements across borders, eliminating the need to use legacy banking infrastructure.

Laws and legislation, including the European MiCA (Markets in Crypto-Assets) program, are contributing to accelerating acceptance with transparency and confidence. Other nations are not far behind, and they are establishing an ecosystem where tokenization can successfully take place across the world.

Key Use Cases of Real-World Asset Tokenization

The idea of tokenization is not a technical innovation, as it is already experienced in different industries.

Real Estate and Private Equity

The property and fund shares can be cut into digital tokens through tokenization. This reduces the barriers to entry to retail investors, increases access to new international markets, and increases liquidity. An example of this would be a residential luxury development that would be allowed to issue 1000 tokens on the subject of fractional ownership so that small-scale investors can invest in it and still be within the confines of the local laws.

Fixed-Income and Alternative Assets

Digital representation is now possible with tokenized bonds and other alternative assets such as rare art, wine, and music rights. Banks can issue tokenized bonds, which settle immediately, and investors can trade other assets in a secure and auditable marketplace, which was not previously possible because of illiquidity.

Cross-Border Settlements with Stablecoins

Stablecoins are becoming the preferred method of making settlements in trade around the world. They are digital and have inbuilt compliance regulations, enabling business transactions between countries to be made faster and with greater security, without using the usual traditional payment rails, yet they comply with regulations.

Alternative Assets and Tokenization Opportunities

Traditional financial instruments are not the only ones that can be tokenized. Intellectual property, music royalties, wine, art, and other rare assets are increasingly represented electronically. Historically, these markets are characterized by low liquidity, high transaction costs, and low transparency. These challenges are tackled in tokenization by:

- Fractional Ownership – Fine art is a high-value asset that may be divided into tokens, and multiple investors may share ownership.

- Global Access – The tokens are able to be sold to investors all around the world without geographical restrictions.

- Automated Royalties and Dividends – Smart contracts distribute revenue based on ownership shares on an automatic basis.

- Improved Liquidity in Markets – Tokenized assets can be exchanged on digital marketplaces, improving liquidity in markets that were illiquid in the past.

To illustrate this point, a music label can tokenize the royalties received by a popular album so that fans and small investors can receive automated streams of revenue whenever the song is played. Similarly, collectible wine or rare art can be exchanged as fractional tokens, which have been tying up value in monopolistic markets.

DeFi Liquidity and RWA Trading

One of the key aspects of finance has been liquidity. RWAs in the form of tokens combined with DeFi protocols have the potential to dramatically increase market liquidity. Decentralized exchanges (DEXs) and automated market makers (AMMs) enable the 24/7 trading of tokenized assets without any intermediaries.

As an example, a tokenized real estate property may be listed on a DEX where the selling and buying parties communicate in real-time. With smart contracts, the records of ownership are updated in real time, and money is transferred safely. TradFi combined with DeFi infrastructure can enable markets to become more efficient, enabling smaller investors to get involved without compromising compliance and transparency.

In addition, tokenized assets can be collateralized using DeFi liquidity pools, allowing individuals to borrow, lend, or stake their tokens. This type of combination fills the gap between old financial services and new financial services and builds a dynamic ecosystem that can transform retail and institutional investors.

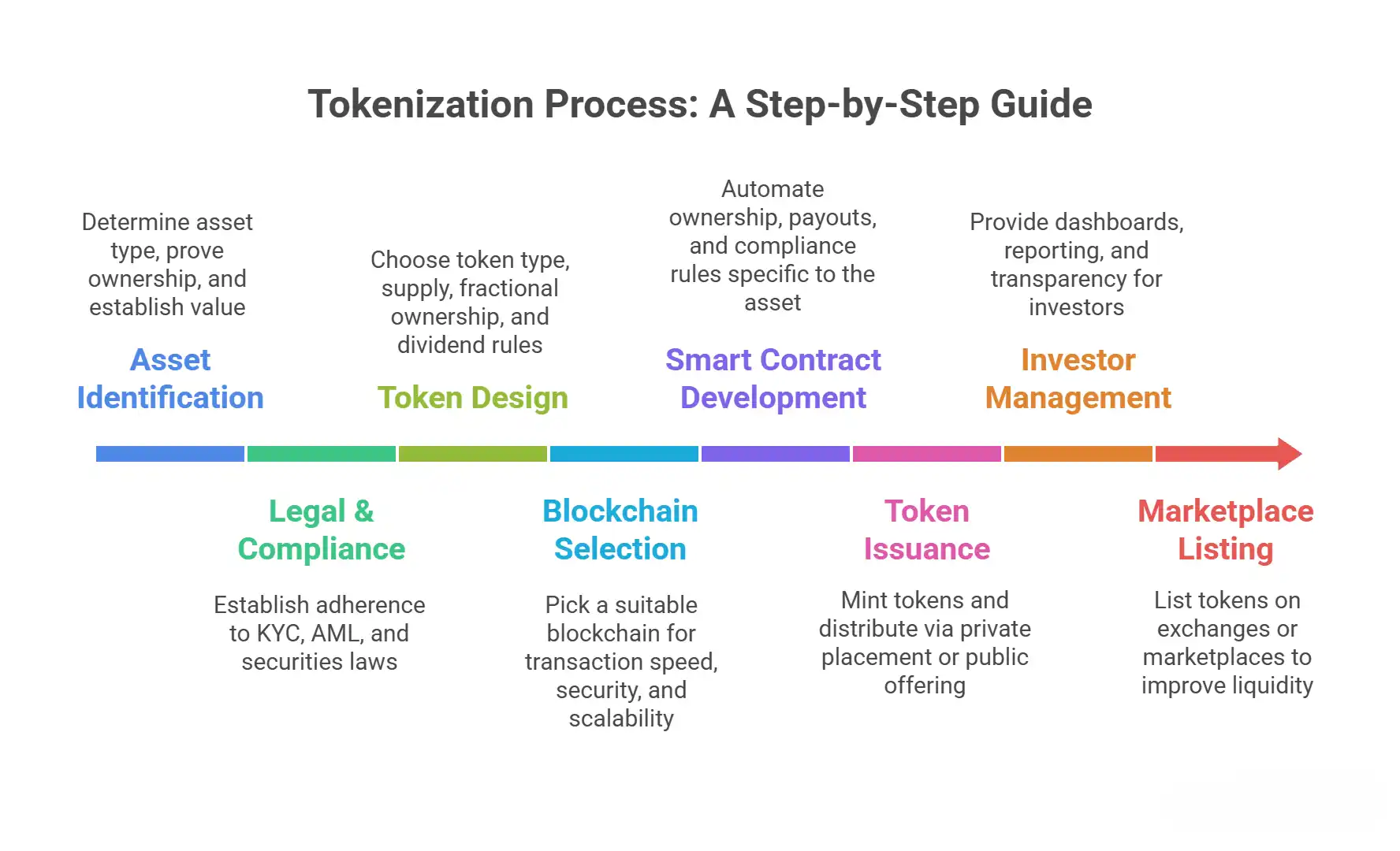

Step-by-Step Process of Tokenizing Real-World Assets

The concept of tokenization must be planned carefully to strike a balance between the benefits of the blockchain and the real-life legal considerations. The operations may be summed up as follows:

- Asset Identification – Determine asset type (real estate, bond, artwork, intellectual property), prove ownership, solve disputes, and determine value.

- Legal and Compliance Establishment – Ensure adherence to KYC, AML, and securities laws, and structure tokens to comply with local laws.

- Token Structuring and Design – Determine type (equity, debt, utility), overall supply, fractional ownership and dividend, voting, or transfer rules.

- Selection of Blockchain Platform – Select the most suitable blockchain (Ethereum, Polygon, or private chain) depending on transaction requirements, security, and scalability.

- Smart Contract Development – Automate ownership, payouts, and compliance, and add asset-specific rules.

- Token Minting and Issuance – Produce digital tokens and issue them to investors through either a private placement or a public issue.

- Investor Management – Provide dashboards, transaction history, and periodic reporting to ensure transparency.

- Listing on secondary marketplace (exchange) – Marketplaces in exchanges or marketplaces, or improve liquidity.

- Continued Reporting and Compliance – Maintain chain accounts, legal reporting, and asset performance reports to investors and regulators.

Advantages of Tokenized Assets

Many advantages can be gained by being tokenized:

- Retail Access – Fractional ownership allows small investors to invest in prime markets.

- Liquidity – Assets are not bound by any limitations, and the market becomes more efficient.

- Transparency – On-chain records are auditable and regulated.

- Automation – Smart contracts can help lower the cost of operation due to the automation of payouts, compliance, and reporting.

- New Asset Classes – Categories such as energy, IP, and carbon credits can effectively address ownership and capital.

Challenges and Regulatory Considerations

Although tokenization has many benefits, there are certain drawbacks:

- Legal Uncertainty – Various jurisdictions are taking different approaches toward tokenized securities. Companies have to operate within the securities laws.

- Technology Risk – Smart contracts are automated, but still may have bugs or vulnerabilities. This must be continuously audited.

- Market Acceptance – Retail investors might not have much knowledge about digital tokens yet, and they need education and trust-building campaigns.

- Regulatory Compliance – MiCA-type regulatory models must be adjusted to international standards, with KYC, AML, and investor protection becoming mandatory.

Those barriers can be addressed by bringing on board tech developers, legal consultants, and financial institutions, and that is what Idealogic is in the process of doing to make the tokenization projects both legal and technically possible.

Global Trends in Asset Tokenization

Both technological advancement and regulatory approval are promoting the practice of tokenization globally. The market is being influenced by several trends:

- CBDC Integration – CBDCs are being experimented with to facilitate instant settlements of tokenized value, without relying on the old banking infrastructure.

- Cross-Border Investments – Tokenized assets allow participation on a global scale without the cost and time delays of traditional international transactions.

- Regulatory Frameworks – MiCA in Europe and comparable projects in Asia and the Americas offer the legal clarity to increase investor confidence.

- Institutional Adoption – Banks, hedge funds, and insurance companies have been considering tokenized RWAs to enhance efficiency, compliance, and accessibility.

- AI and Risk Management – The MLA assists in pricing token assets, ranking risk, and forecasting market results.

Such developments imply the trend towards a more open-ended and technology-based financial system where token assets no longer represent a niche product but a mass investment instrument.

Future Outlook: Where Tokenized RWAs Are Headed

RWAs that are tokenized are no longer just pilot programs. Central banks are exploring CBDCs to improve settlements, AI may help them score risks and set asset prices, and ETFs based on RWA or index tokens can add additional portfolio diversification. Governments and financial institutions are developing scaling platforms and standards to achieve scalability in holding larger assets. Technology, regulation, and innovation are combining to make the world financial system more inclusive, transparent, and efficient.

- AI and Risk Management – Machine learning models are used to dynamically price tokenized assets, enhance the risk scoring, and detect arbitrage opportunities.

- RWA ETFs and Index Funds – Investors are exposed to diversified baskets of tokenized real-world assets.

- Global Financial Inclusion – It is now possible to open markets previously closed to retail investors on a global scale.

- Corporate Use Cases – Corporations issue tokens representing company shares or IP rights to raise funds more cost-effectively and openly.

The Future of Financial Markets with Tokenization

Tokenization will fundamentally change financial markets:

- Greater Retail Participation - Fractional ownership allows small investors to own high-value assets.

- Efficient Global Trading – Tokenized assets are capable of moving instantly across borders and can save on costs and delays.

- Automated Compliance – Smart contract imposes rules and regulations to reduce human error and the cost of operation.

- New Investment Classes – Energy credits, carbon credits, and digital IP are tokenizable, and new markets are formed.

- Institutional Integration – Banks and regulators are starting to investigate hybrid forms of finance to utilize tokenization without losing trust and oversight.

As an intermediary between TradFi and DeFi, tokenization brings the traditional and digital-native investor closer together.

Case Studies and Real-World Applications

It brings liquidity, transparency, and fills the TradFi DeFi innovation gap.

- Real Estate Tokenization – A developer of luxury high-rise properties based in Berlin, Germany, issued tokenized shares of one of their properties, enabling thousands of small investors around the world to own a share, which is 3x more liquid than traditional fractional ownership.

- Bond Tokenization – A European bank issued a tokenized government bond, which allows programmable delivery of interest and automated settlement in minutes to reduce operating expenses 60 times.

- Alternative Assets – Music rights and artworks are being tokenized, which allows them to be owned fractionally and traded immediately all around the globe, making it possible to build completely new investment ecosystems.

To sum up

The concept of tokenization is transforming the manner in which real-life assets are accessed, traded, and managed. It adds liquidity, transparency, and closes the TradFi to DeFi innovation gap. At Idealogic, we are also experts in token structure and blockchain systems that can aid companies in transforming real estate, company shares, or bonds into secure electronic tokens. End-to-end tokenization solutions enable businesses to access investors globally, improve transparency, and be ready to enter the next era of finance.

Be it to enhance access to retail investors, automate compliance, or open new trading opportunities globally, Idealogic has the expertise and technology to transform your assets into digital instruments that are future-ready.